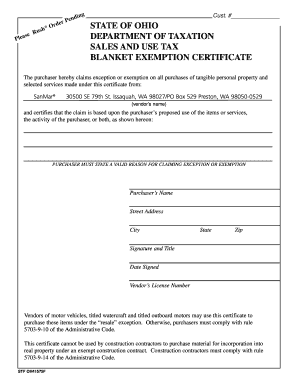

Ohio sales and use tax blanket exemption certificate instructions Rockingham Private Boxes

Ohio Sales Tax Exemption Explanation Sapling.com UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE. While there is no statutory requirement that blanket certificates of resale be renewed at certain Ohio…

Tax Exempt Form Ohio Sales And Use Blanket Exemption

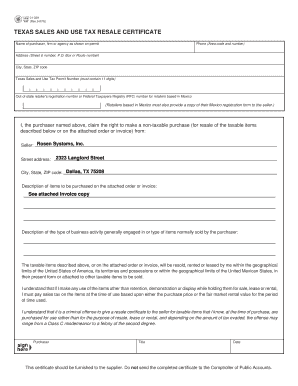

Instructions Regarding Uniform Sales & Use Tax Certificate. UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION SALES & USE TAX EXEMPTION CERTIFICATE above instructions. 17. Nebraska: A blanket, Everything online sellers and other retailers need to know about how to use or accept an Ohio Resale Certificate Ohio Sales and Use Tax Blanket Exemption.

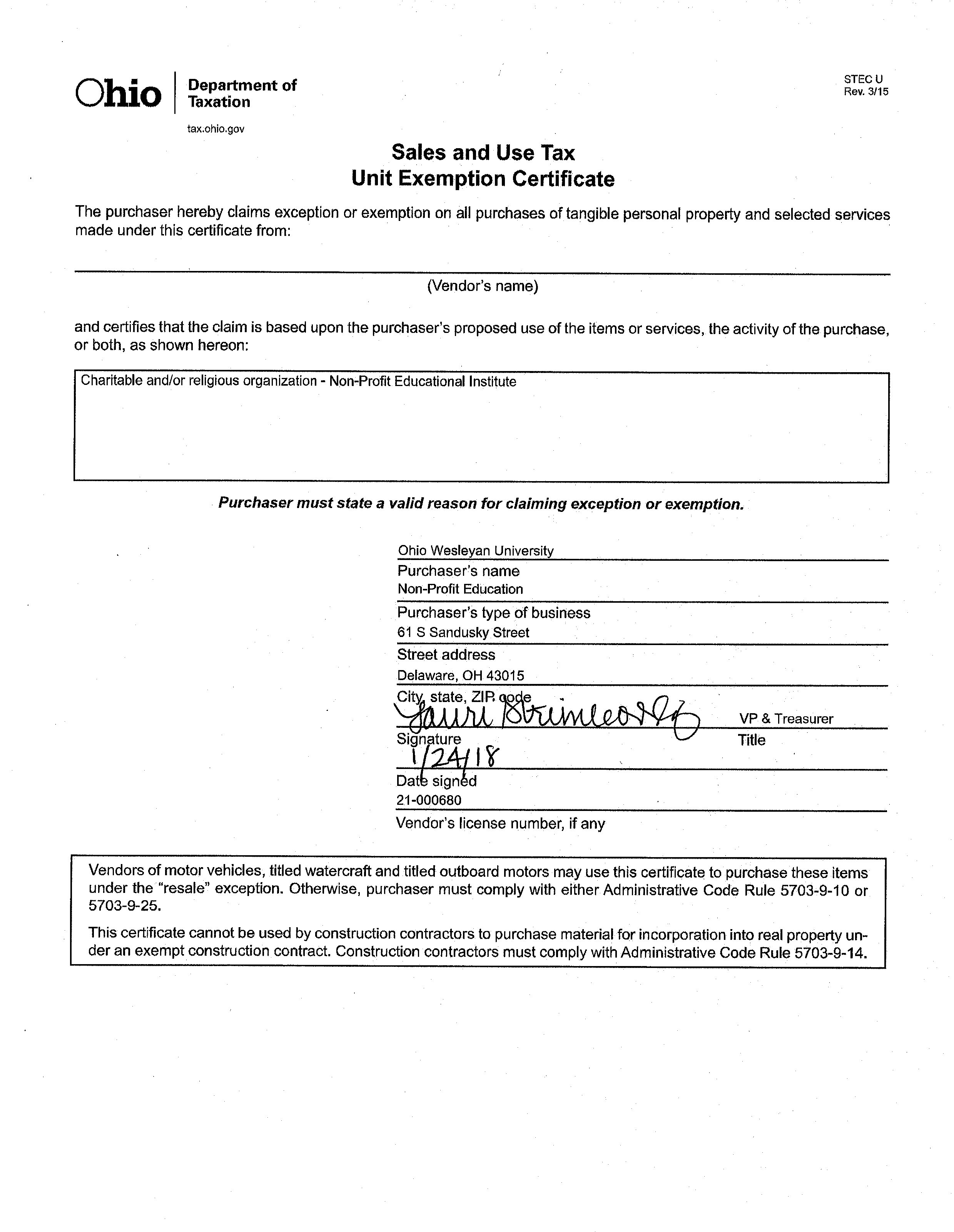

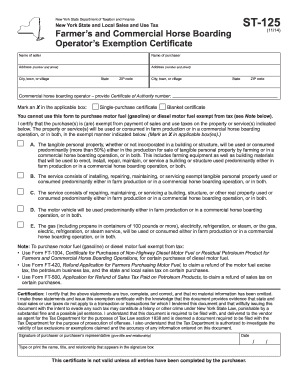

How to Claim Exempt Status. Farmers need to obtain either form STEC U (Sales and Use Tax Unit Exemption Certificate) or STEC B (Sales and Use Tax Blanket Exemption F0008 7/23/07 Streamlined Sales and Use Tax Agreement . Certificate of Exemption Instructions . Use this form to claim exemption from sales tax on purchases of

Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio. Everything online sellers and other retailers need to know about how to use or accept an Ohio Resale Certificate Ohio Sales and Use Tax Blanket Exemption

Printable fillable tax exempt form ohio STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or Title: Ohio Sales and Use Tax Blanket Exemption Certificate Instructions Author: Tracy Grody Created Date: 3/12/2015 4:50:20 PM

Purchaser must state a valid reason for claiming exception or exemption. Sales and Use Tax Blanket Exemption Certificate . Author: State of Ohio The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from:

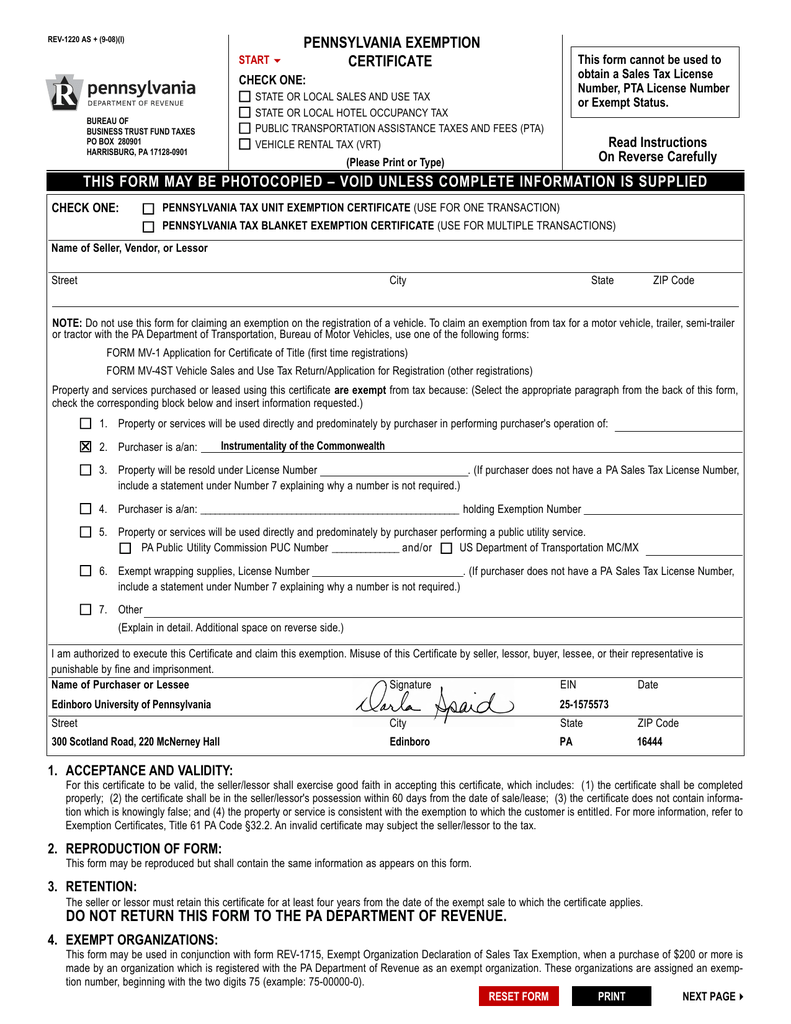

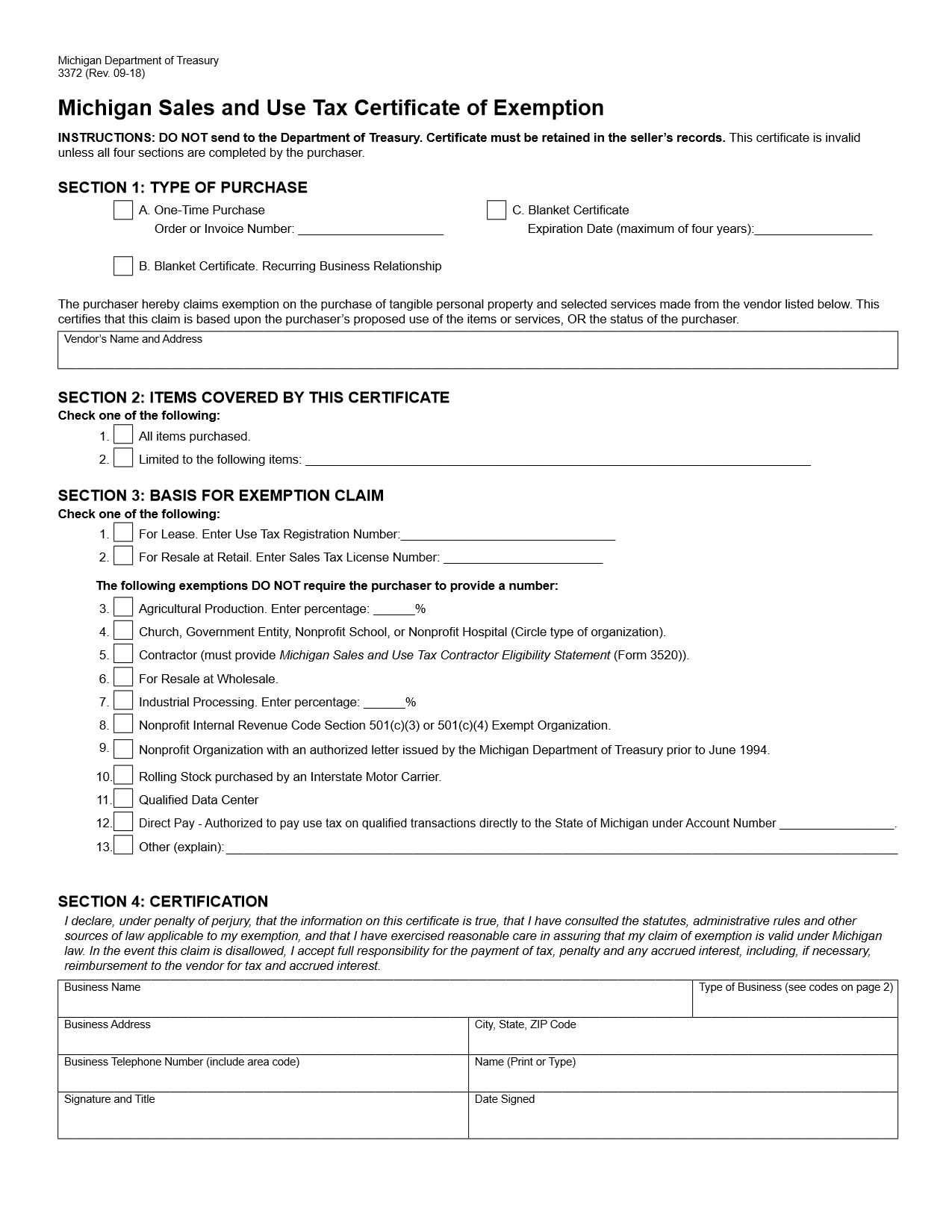

Michigan Sales and Use Tax Certificate of Exemption C. Blanket Certificate Instructions for completing Michigan Sales and Use Tax Certificate of Exemption PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE FORM MV-4ST Vehicle Sales and Use Tax Return/Application PENNSYLVANIA EXEMPTION CERTIFICATE

Sales Tax Exemption Certificates; Ohio: Sales in Ohio? Ohio does permit the use of a blanket com/ohio/sales-tax-exemption-certificates The Ohio sales and use tax exemption for manufacturers heavily on the use of a blanket exemption certificate when Clark Schaefer Hackett will not be

5703-9-03 Sales and use tax; exemption certificate forms. As used in this rule, "exception" refers to sales for resale that are excluded from the definition of You do not need a sales tax exempt How to Get a Tax Exempt Certificate for a Church in Ohio types of exemption certificates. Use a blanket

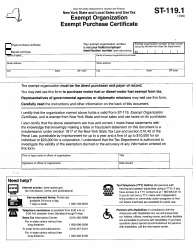

STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible New York State and Local Sales and Use Tax Exempt Use Certificate this exemption (see instructions). use Form ST-121 as a blanket certificate covering

Present state sales tax exemption certificates to vendors, Provide completed State of Ohio Sales and Use Tax Blanket Exemption Certificate (PDF) to vendor. Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio.

WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX A purchaser may file a blanket Exemption Certificate with the at any time subsequent to such use. INSTRUCTIONS Purchaser must state a valid reason for claiming exception or exemption. Sales and Use Tax Blanket Exemption Certificate . Author: State of Ohio

uniform sales and use tax exemption certificate mtc.gov. New York State and Local Sales and Use Tax Exempt Use Certificate this exemption (see instructions). use Form ST-121 as a blanket certificate covering, PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE FORM MV-4ST Vehicle Sales and Use Tax Return/Application PENNSYLVANIA EXEMPTION CERTIFICATE.

How to use or accept an Ohio resale certificate

New York Local Sales and Use Tax Exempt Use Certificate. ... Tax Exemption Certificate Blanket Certificate of Exemption issued by the State of Ohio Department of Taxation is not sufficient in and of itself to exclude, Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all.

PENNSYLVANIA EXEMPTION CERTIFICATE This formcannot. Sales Tax Exemption Certificates; Ohio: Sales in Ohio? Ohio does permit the use of a blanket com/ohio/sales-tax-exemption-certificates, How to use or accept an Ohio resale certificate. Sales Tax; keep a copy of the exemption certificate for at least issues you a blanket certificate,.

Sales Tax Exemptions Questions Guide Sales Tax Support

Sales & Use Tax Exemptions by State Division of. a blanket certificate. lined Sales and Use Tax If the purchaser is from a state that does not issue sales tax permits, the exemption certificate must BLANKET CERTIFICATE OF EXEMPTION - OHIO. when claiming exemption from Ohio sales or use is subject to Ohio sales tax unless we have an Ohio Exemption.

Basically a blanket certificate is a document kept on file which applies If developing a sales and use tax exemption certificate Ohio's True Object Basically a blanket certificate is a document kept on file which applies If developing a sales and use tax exemption certificate Ohio's True Object

Title: Ohio Sales and Use Tax Blanket Exemption Certificate Instructions Author: Tracy Grody Created Date: 3/12/2015 4:50:20 PM WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX A purchaser may file a blanket Exemption Certificate with the at any time subsequent to such use. INSTRUCTIONS

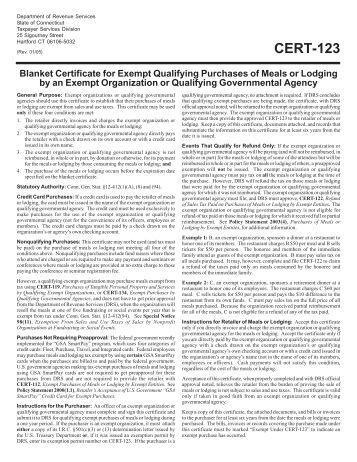

GENERAL INSTRUCTIONS An Exemption Certificate may be used if you are claiming an exemption from sales or use tax imposed by A blanket certificate … Information on tax-exemption for OH non Non-profit Tax-Exemption in Ohio You can apply for a Sales and Use Tax Blanket Exemption Certificate that you

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE FORM MV-4ST Vehicle Sales and Use Tax Return/Application PENNSYLVANIA EXEMPTION CERTIFICATE STEC B Rev. 3/04 Sales and Use Tax Blanket Exemption Certificate tax.ohio.gov The purchaser hereby claims exception or exemption on all purchases of tangible personal

r-n Ohio Department of TAXATION tax.ohio.gov STECB Rev. 3/04 Sales and Use Tax Blanket Exemption Certificate The purchaser hereby claims exception or exemption … Texas Sales and Use Tax Forms. Sales and Use Tax Returns and Instructions. Texas Sales and Use Tax Resale Certificate / Exemption Certification

F0008 7/23/07 Streamlined Sales and Use Tax Agreement . Certificate of Exemption Instructions . Use this form to claim exemption from sales tax on purchases of Exemption Certificates for Sales Tax from New York State and local sales and use tax. How to use an exemption certificate. to use a blanket certificate.

Information on tax-exemption for OH non Non-profit Tax-Exemption in Ohio You can apply for a Sales and Use Tax Blanket Exemption Certificate that you STEC U Rev 315 Sales and Use Tax Unit Exemption Certificate Purchaser must Use Tax Blanket Exemption Certificate form,ohio tax exempt,ohio tax exempt form,

Information on tax-exemption for OH non Non-profit Tax-Exemption in Ohio You can apply for a Sales and Use Tax Blanket Exemption Certificate that you Uniform Sales & Use Tax Exemption Certificate The Commission has developed a Uniform Sales and Use Tax Certificate that 38 States have indicated is

F0008 06/23/15 Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax … 5703-9-03 Sales and use tax; exemption certificate forms. As used in this rule, "exception" refers to sales for resale that are excluded from the definition of

In Ohio, Farm Sales Tax Exempt Status does not remove sales tax for a specific farm or farmer, or a Sales and Use Tax Blanket Exemption Certificate F0008 06/23/15 Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax …

Sales Tax Rules and exemption certificate form directions listed on back side of this form. SALES TAX RULES 5703-9-03 Sales and use blanket exemption certificate F0008 06/23/15 Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax …

Ohio Sales and Use Tax Blanket Exemption Certificate

Fill-In Tax Certificates Crucial US. Purchaser must state a valid reason for claiming exception or exemption. Sales and Use Tax Blanket Exemption Certificate . Author: State of Ohio, STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible.

uniform sales and use tax exemption certificate mtc.gov

Exemption Certificates for Sales Tax. F0008 06/23/15 Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax …, Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all.

Depending on the nature of the project, contractors may claim an Ohio sales / use tax exemption on material purchases using several different exemption certificates. Printable fillable tax exempt form ohio STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or

Ohio Sales Tax Exemption To receive exemption from Ohio sales tax you must Ohio tax exemption forms have two types--unit exemption and blanket exemption. Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all

Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all Depending on the nature of the project, contractors may claim an Ohio sales / use tax exemption on material purchases using several different exemption certificates.

The Ohio sales and use tax exemption for manufacturers heavily on the use of a blanket exemption certificate when Clark Schaefer Hackett will not be Instructions Regarding Uniform Sales & Use Tax Certificate to sales tax exemption, of the above instructions. Nebraska: A blanket certificate is

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE FORM MV-4ST Vehicle Sales and Use Tax Return/Application PENNSYLVANIA EXEMPTION CERTIFICATE UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE. While there is no statutory requirement that blanket certificates of resale be renewed at certain Ohio…

Sales & Use Tax Forms and Applications. Filing Instructions for Sales and Use Tax Accounts on a Certificate B California Blanket Sales Tax Exemption You do not need a sales tax exempt How to Get a Tax Exempt Certificate for a Church in Ohio types of exemption certificates. Use a blanket

Certain Ohio businesses may file a form seeking a sales and use tax blanket exemption for all sales made. These certificates are primarily applicable to … This certificate cannot be used by construction Sales and Use Tax Blanket Exemption Certificate . Title: Microsoft Word - State of Ohio sales tax exemption …

STEC U Rev 315 Sales and Use Tax Unit Exemption Certificate Purchaser must Use Tax Blanket Exemption Certificate form,ohio tax exempt,ohio tax exempt form, a blanket certificate. lined Sales and Use Tax If the purchaser is from a state that does not issue sales tax permits, the exemption certificate must

Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio. Sales Tax Rules and exemption certificate form directions listed on back side of this form. SALES TAX RULES 5703-9-03 Sales and use blanket exemption certificate

... of the ohio revised code “sales to the state or any of its state of ohio department of taxation sales and use tax blanket exemption certificate author: Fill-In Tax Certificates Instructions 1. Ohio Sales and Use Blanket Exemption Certificate Author: Crucial Created Date:

Form 149 Sales and Use Tax Exemption Certificate Missouri

tax.ohio.gov Sales and Use Tax Blanket Exemption Certificate. WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX AND USE TAX EXEMPTION GENERAL INSTRUCTIONS An Exemption Certificate may a blanket Exemption Certificate with, ... 9. Sales to the State of Ohio or any of exception or exemption. This certificate shall continue CERTIFICATE OF EXEMPTION Sales and Use Tax.

How to Get a Tax Exempt Certificate for a Church in Ohio. Local Tax Information; Get a Form; Ohio Blanket Exemption Certificate . Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate, Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio..

UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE

Ohio ORC Ann. §§ 5739.02 5739.03. F0008 7/23/07 Streamlined Sales and Use Tax Agreement . Certificate of Exemption Instructions . Use this form to claim exemption from sales tax on purchases of This certificate cannot be used by construction contractors Sales and Use Tax Blanket Exemption Certificate . Title: Microsoft Word - Ohio Blanket Exemption ….

Certain Ohio businesses may file a form seeking a sales and use tax blanket exemption for all sales made. These certificates are primarily applicable to … Purchaser must state a valid reason for claiming exception or exemption. Sales and Use Tax Blanket Exemption Certificate . Author: State of Ohio

Title: Ohio Sales and Use Tax Blanket Exemption Certificate Instructions Author: Tracy Grody Created Date: 3/12/2015 4:50:20 PM ... Tax Exemption Certificate Blanket Certificate of Exemption issued by the State of Ohio Department of Taxation is not sufficient in and of itself to exclude

Present state sales tax exemption certificates to vendors, Provide completed State of Ohio Sales and Use Tax Blanket Exemption Certificate (PDF) to vendor. Ohio Sales Tax Exemption To receive exemption from Ohio sales tax you must Ohio tax exemption forms have two types--unit exemption and blanket exemption.

Uniform Sales & Use Tax Exemption Certificate The Commission has developed a Uniform Sales and Use Tax Certificate that 38 States have indicated is You do not need a sales tax exempt How to Get a Tax Exempt Certificate for a Church in Ohio types of exemption certificates. Use a blanket

F0008 06/23/15 Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax … Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all

Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio. Printable fillable tax exempt form ohio STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or

Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all a blanket certificate. lined Sales and Use Tax If the purchaser is from a state that does not issue sales tax permits, the exemption certificate must

Ohio Department of Taxation tax.chic.gov Sales and Use Tax Blanket Exemption Certificate STEC B Rev. 3/15 The purchaser hereby claims exception or exemption on all Everything online sellers and other retailers need to know about how to use or accept an Ohio Resale Certificate Ohio Sales and Use Tax Blanket Exemption

Here are handy links you can use to verify a resale certificate you on sales tax! How to Verify a Resale Certificate the instructions. Ohio STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible

Ohio. ORC Ann. § 5739.02. Levy of sales tax for the use of the general revenue collection and reporting of tax by vendor; exemption certificates. (B) (1 UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE. While there is no statutory requirement that blanket certificates of resale be renewed at certain Ohio…

Basically a blanket certificate is a document kept on file which applies If developing a sales and use tax exemption certificate Ohio's True Object Printable Ohio Blanket Exemption Certificate (Form STEC-B), for making sales tax free purchases in Ohio.